How much in Taxes are you Actually Paying?

Your tax bracket does not necessarily equal what you will pay.

Spend the money you save on taxes on building a beautiful backyard for your family and entertaining! This one is courtesy of our gorgeous Parc Forêt Model Home.

There’s a reason that people turn to professionals when it comes to their taxes: this stuff is confusing! For instance, you may think that because you are in the 25% tax bracket, that means you pay about 25 percent of your income in taxes each year. Not necessarily. That is a marginal rate that is only applicable to some of your income. After you remove deductions and credits and add in taxes, like Social Security, that aren’t part of your income tax*. Thankfully, the Tax Policy Center did the leg work and came up with some numbers. According to the nonpartisan research group, on average American’s will pay 19.8% of their income in taxes to the federal government (not including state and city taxes in some states).

*Nevada residents do not pay state income tax! Click here to find out how tax friendly our state is.

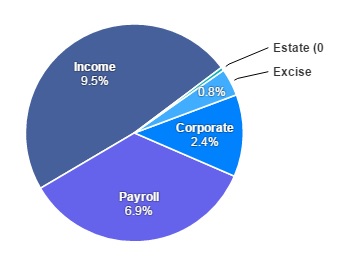

Average American’s will typically pay 19.8% of their income in taxes each year, depicted in this chart. Nevadan’s however, do not have to pay corporate or personal income tax!

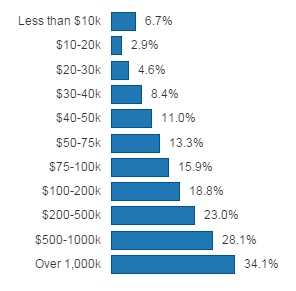

Most of your tax dollars come from your personal income tax, payroll tax and corporate tax. Here in Nevada, we don’t pay personal income tax or corporate tax! While the average taxation is 19.8 percent, most people will pay less than that because the number is skewed by those earning considerably high amounts. The Tax Policy Center broke down the average federal tax burden by income level so you can get a better idea of what you’ll be paying come April.

Charts from MONEY.

Follow Parc Forêt on Facebook, Twitter, Pinterest and Instagram to stay up to date on all things taxation, as well as Montrêux events and what’s happening in the Reno-Tahoe area!

For real estate inquiries, stop by the beautiful Montrêux Welcome Center at 16475 Bordeaux Dr. in Reno, NV or call us at 775.849.9444. The Welcome Center is open 7 days a week, from 9:00 am – 5:00 pm.